Für welchen

Businessbereich suchen Sie nach Lösungen?

Unsere Lösung für ein automatisches Lager passt auch in bestehende Lagerhallen und sorgt für eine pünktliche und zuverlässige Belieferung.

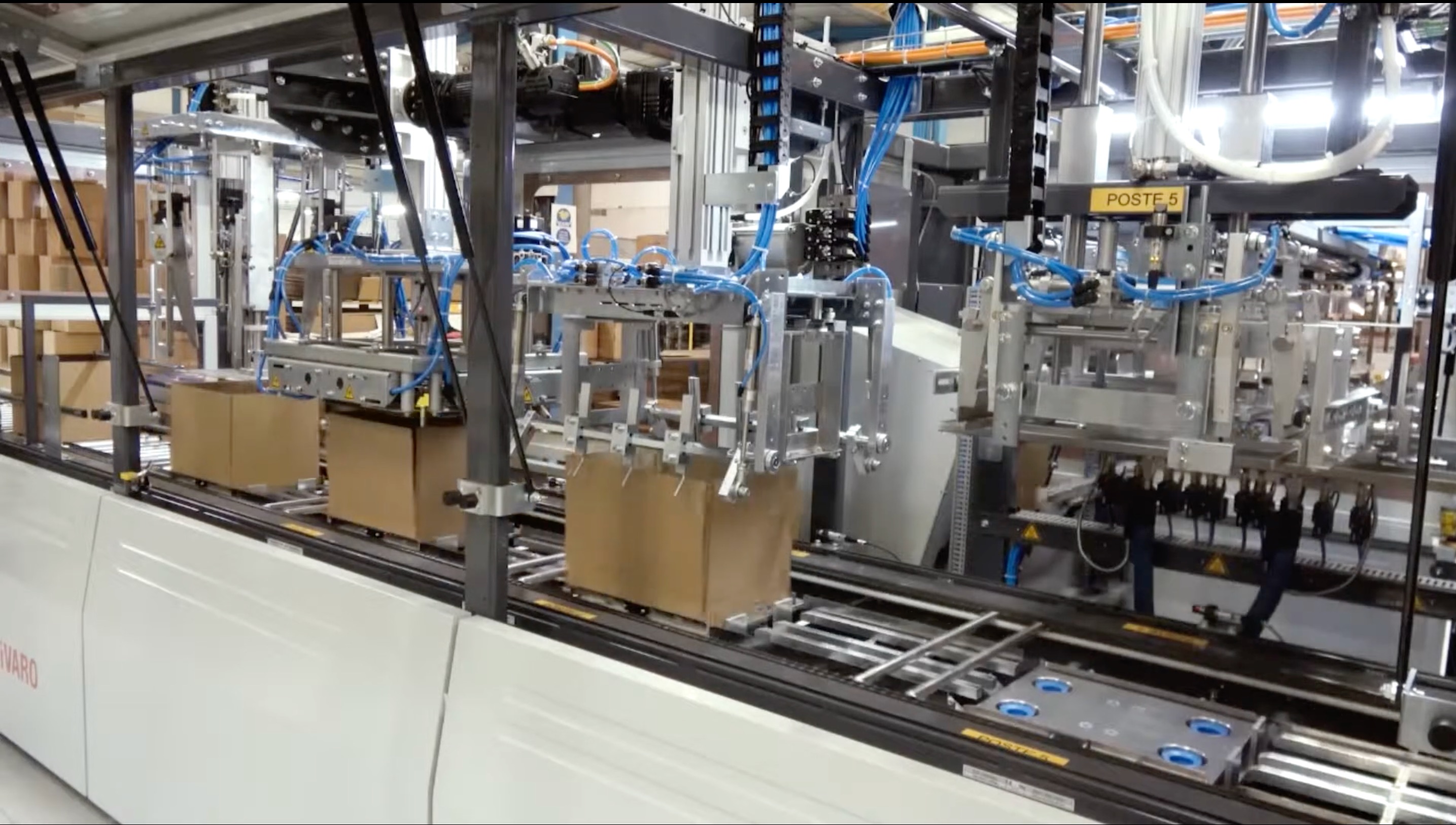

Ob 3D-Packaging, Höhenreduzierung, Kartonaufrichter- /verschließer, Trayformer oder Bedeckler – wir haben die passende Lösung für Sie!

Unsere Lösung für ein automatisches Lager passt auch in bestehende Lagerhallen und sorgt für eine pünktliche und zuverlässige Belieferung.

Ob 3D-Packaging, Höhenreduzierung, Kartonaufrichter- /verschließer, Trayformer oder Bedeckler – wir haben die passende Lösung für Sie!

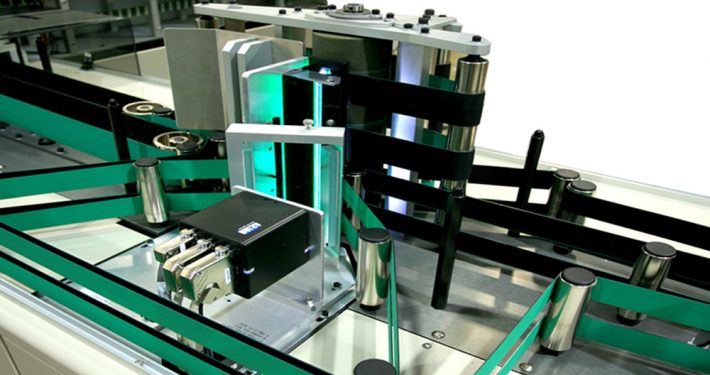

Steigern Sie Ihren Durchsatz und Ihre Qualität mithilfe eines automatischen Sortiersystems!

Unsere Lösung für ein automatisches Lager passt auch in bestehende Lagerhallen und sorgt für eine pünktliche und zuverlässige Belieferung.

Ob 3D-Packaging, Höhenreduzierung, Kartonaufrichter- /verschließer, Trayformer oder Bedeckler – wir haben die passende Lösung für Sie!

Steigern Sie Ihren Durchsatz und Ihre Qualität mithilfe eines automatischen Sortiersystems!

Steigern Sie Ihren Durchsatz und Ihre Qualität mithilfe eines automatischen Sortiersystems!

Für welche

Aufgabe suchen Sie eine Lösung

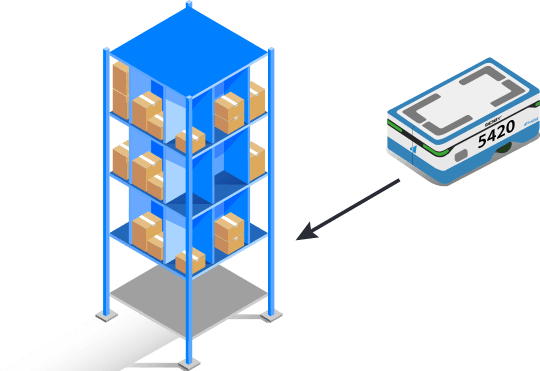

Unsere Lösung für ein automatisches Lager passt auch in bestehende Lagerhallen und sorgt für eine pünktliche und zuverlässige Belieferung.

Durch autonome Roboter werden die Waren direkt zu den Mitarbeitern transportiert. Dadurch werden überflüssige Wege eingespart und die Lagerflächen optimiert.

Durch autonome Roboter werden die Waren direkt zu den Mitarbeitern transportiert. Dadurch werden überflüssige Wege eingespart und die Lagerflächen optimiert.

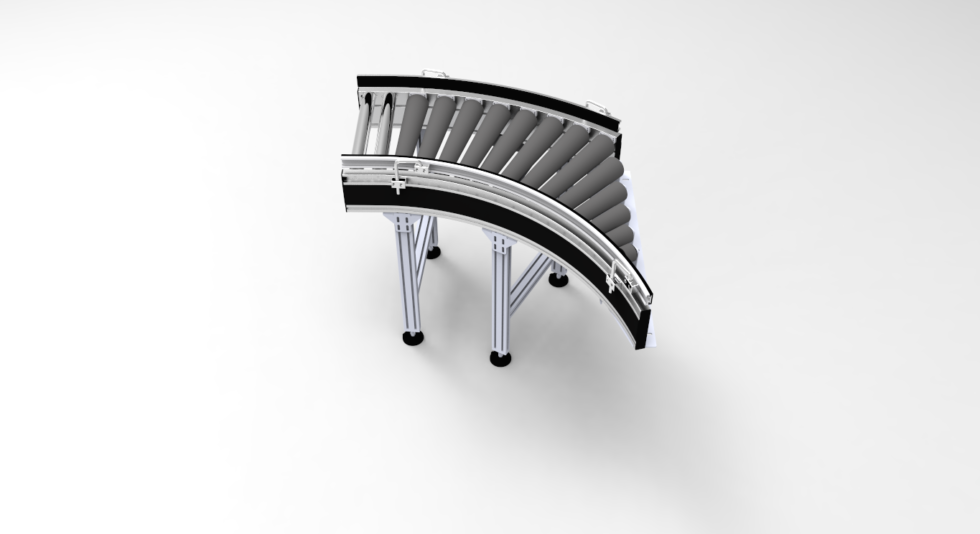

Steigern Sie Ihren Durchsatz und Ihre Qualität mithilfe eines automatischen Sortiersystems!

Ob 3D-Packaging, Höhenreduzierung, Kartonaufrichter- /verschließer, Trayformer oder Bedeckler – wir haben die passende Lösung für Sie!

Steigern Sie Ihren Durchsatz und Ihre Qualität mithilfe eines automatischen Sortiersystems!

Nach welcher

Lösung suchen Sie?

Zuverlässige Verarbeitungsleistung mit hohem Durchsatz und hoher Verfügbarkeit

Steigern Sie Ihre Effiezenz mit unseren automatischen Sortiersystemen!

Verabschieden Sie sich mit unseren Lösungen für maßgeschneiderte Verpackungen vom übermäßigen Verbrauch an Verpackungsmaterial und schonen Sie damit die Umwelt!

Automatisieren Sie Ihre manuellen Verpackungsprozesse und steigern Sie Ihre Produktivität und Ihren Automatisierungsgrad, um eine optimale Produktionsverfügbarkeit zu gewährleisten

Egal ob Tray- oder Kartonformat – wir finden die passende Lösung für Sie!

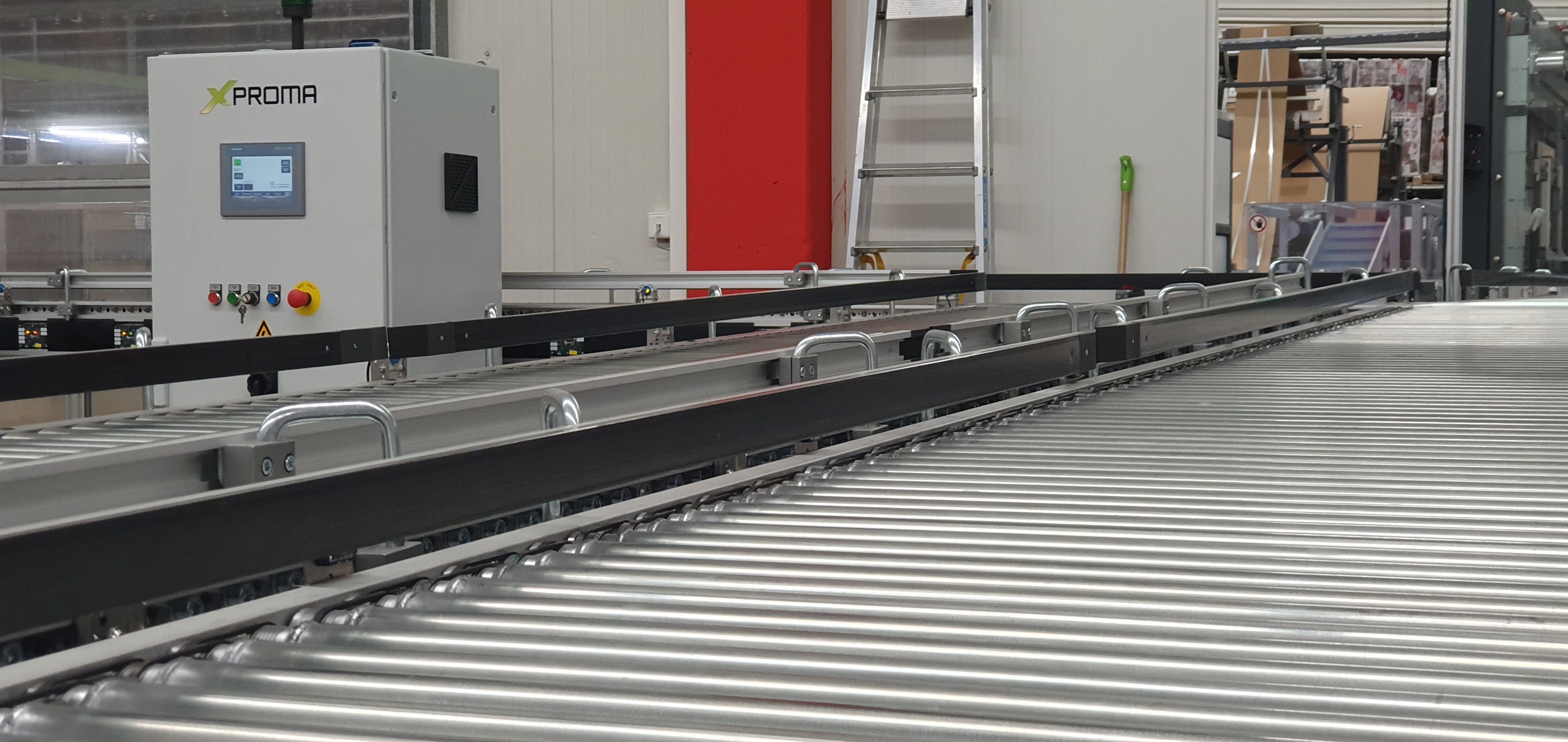

Das modulare Baukastensystem um Waren innerbetrieblich ohne Unterbrechungen zu bewegen.

Ob zur Integration in unsere Fördertechnik oder als Sortierziel – mit unseren Module finden haben wir die passende Lösung für Ihren Anwendungsfall!

Für Ihre Anforderung die passende Lösung – gerne bieten wir Ihnen spezifische Lösungen für Ihr Projekt!

Unsere Lösung für ein automatisches Lager passt auch in bestehende Lagerhallen und sorgt für eine pünktliche und zuverlässige Belieferung.

Durch autonome Roboter werden die Waren direkt zu den Mitarbeitern transportiert. Dadurch werden überflüssige Wege eingespart und die Lagerflächen optimiert.

WIR HABEN FÜR JEDEN ANWENDUNGSFALL DIE PASSENDE LÖSUNG

EIN AUSZUG UNSERES PORTFOLIOS

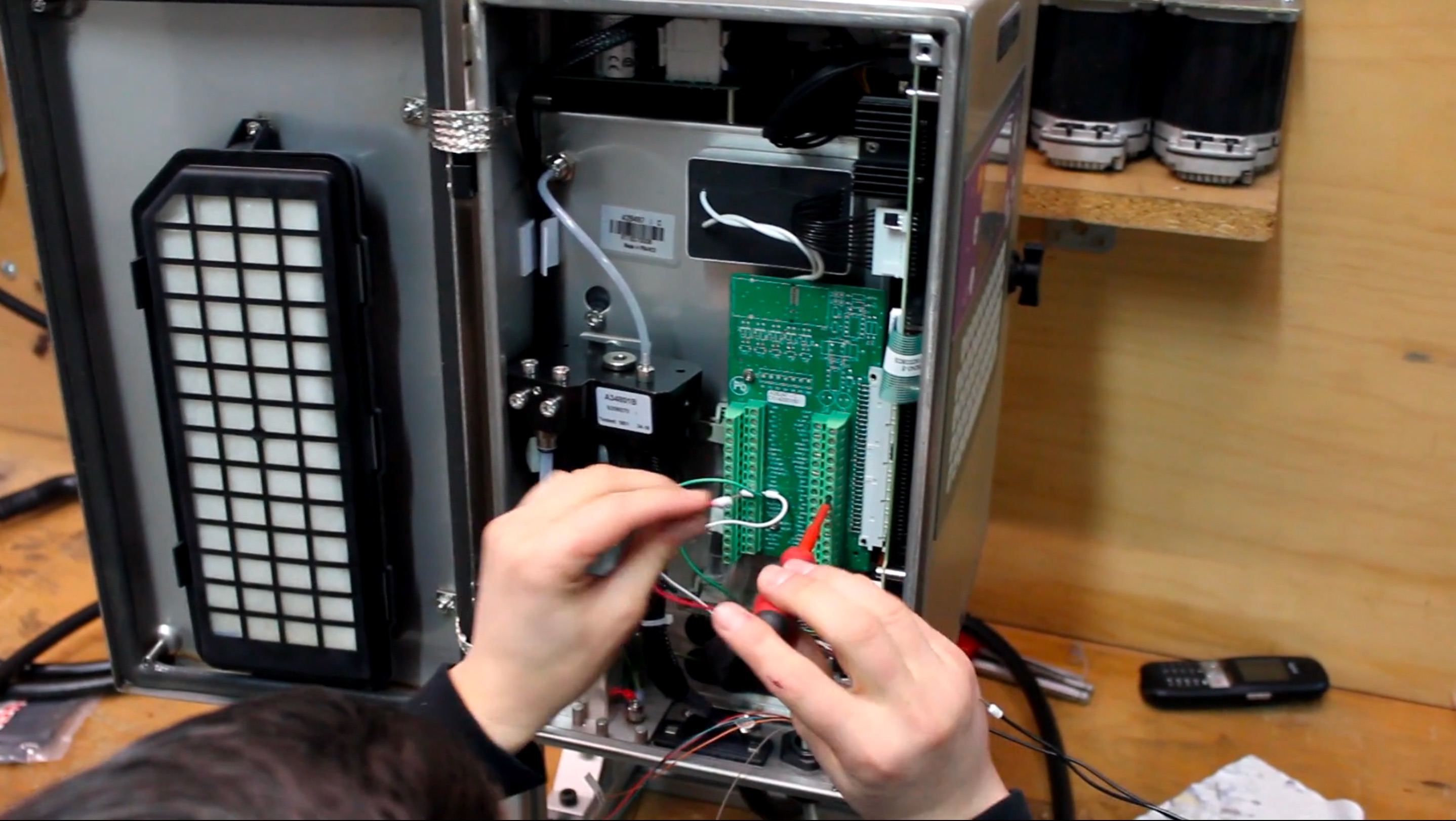

Wir treten herstellerunabhängig mit hohem Individualisierungsgrad der eingesetzten Technik auf.

Dabei bieten wir die Beratung, Planung, Softwareentwicklung, Projektrealisierung, Service und Wartung aus einer Hand.

Auf das Know-how unserer Projektleiter und Techniker vertrauen Unternehmen aus den unterschiedlichsten Branchen.

NEWSLETTER

Melden Sie Sich für unseren Newsletter an.

Abonnieren Sie unseren kostenfreien Newsletter und bleiben Sie immer auf dem Laufenden.